|

|

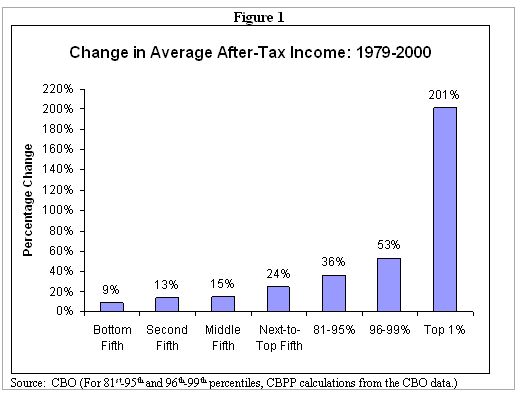

<< Jon Stewart Sums up Davis | Main | EU Sanity on Software Patents >> September 25, 2003Income Gap Soared Since 1979A new study by the Center for Budget Policy and Priorities shows that the economic "boom" existed only for the very wealthy-- for everyone else it was a tiny firecracker with an only marginal increase in income.

Posted by Nathan at September 25, 2003 08:50 AM Related posts:

Trackback PingsTrackBack URL for this entry: CommentsIt's not clear whether or not those numbers take inflation into account. Posted by: dmm at September 25, 2003 11:24 AM It's clear that they do, since non-inflation adjusted income would have increased far more otherwise. Posted by: Nathan Newman at September 25, 2003 01:32 PM Combine these figures with the unemployment numbers and it's starting to look like 1929 is trying to make a rerun. Of course, back then we didn't have a half trillion dollars to borrow, and it may very well be that the deficit is the only thing stopping us from repeating that. This of course is not to say that we shouldn't be too worried about the deficit, because if we don't worry about it, the "lenders" may decide to simply shut down our credit line. The question then is how to worry about the deficit, and the above numbers strongly suggest the answer: that high end income concentration neeeds to be tapped and directed aggressively at rebuilding a strong American job base. Posted by: Benedict@Large at September 26, 2003 06:43 AM Pretty disgusting - although I would also be interested in seeing the figures on how/whether mobility across those quintiles changed. Posted by: paul at September 26, 2003 09:11 AM Nathan, could you provide income amounts for those percentage breakdowns? Posted by: Chuck Nolan at September 26, 2003 12:03 PM Chuck- Look at Appendix A of the linked post for income levels. Posted by: Nathan Newman at September 26, 2003 12:13 PM A few points, recognizing that income does not equal wealth: I don't see any mention of statistics regarding *wealth*, so it is misleading to write, as CBPP does, " that the income gap between the very wealthy and the rest of the nation widened dramatically in the 1990s for the second consecutive decade". Also, for comparisons of who is doing well, and for the appropriate policy implications, we MUST know how many of the top 1% in 1979 were still in the top 1% in 2000! These aren't all the same people! If we want to analyze wealth and income together, we must look at how people move across the income distribution over time. How can CBPP write policy prescriptions without knowing how many people share in that top 1% over 21 years? We also don't see how much of this top 1% income is actually tied up as working capital (reinvested dividends, etc.) to make goods and services that the bottom 99% consumes and works to produce. Posted by: Kevin Brancato at September 27, 2003 07:40 AM We also don't see how much of this top 1% income is actually tied up as working capital (reinvested dividends, etc.) to make goods and services that the bottom 99% consumes and works to produce. Reasonable points about mobility across the quintiles and about measuring wealth vs. income. This graph alone doesn't purport to be a complete analysis. People have done a lot of empirical work on those other issues (for example, my recollection of the most recent studies I had seen was that the distribution of wealth is much more skewed than the distribution of income. But about the "working capital" question, I would think that answer wouldn't add a whole lot to our evaluation of the distribution of income information. How much stuff are the people at the bottom consuming that is made possible by the investments of the people at the top (granting your premise for the sake of discussion)? Isn't the answer going to be pretty closely linked to the income of the people at the bottom? Yes, there is consumer credit, and some people may have assets they can rely on other than current income; but I'd be surprised if the consumption of the bottom quintile consistently outstripped their income by a significant proportion. So if the investments of the rich are creating goods and services and/or income-producing jobs for the poor and middle, that should be reflected in the income chart itself to a reasonable degree. Posted by: J. J. at September 27, 2003 01:05 PM Post a comment

|

Series-

Social Security

Past Series

Current Weblog

January 04, 2005 January 03, 2005 January 02, 2005 January 01, 2005 ... and Why That's a Good Thing - Judge Richard Posner is guest blogging at Leiter Reports and has a post on why morality has to influence politics... MORE... December 31, 2004 December 30, 2004 December 29, 2004 December 28, 2004 December 24, 2004 December 22, 2004 December 21, 2004 December 20, 2004 December 18, 2004 December 17, 2004 December 16, 2004

Referrers to site

|